TEXT & CONTEXT: FULL-RESERVE BANKING

Current Affairs for 26th July, 2023 from "THE HINDU".

TEXT & CONTEXT: FULL-RESERVE BANKING

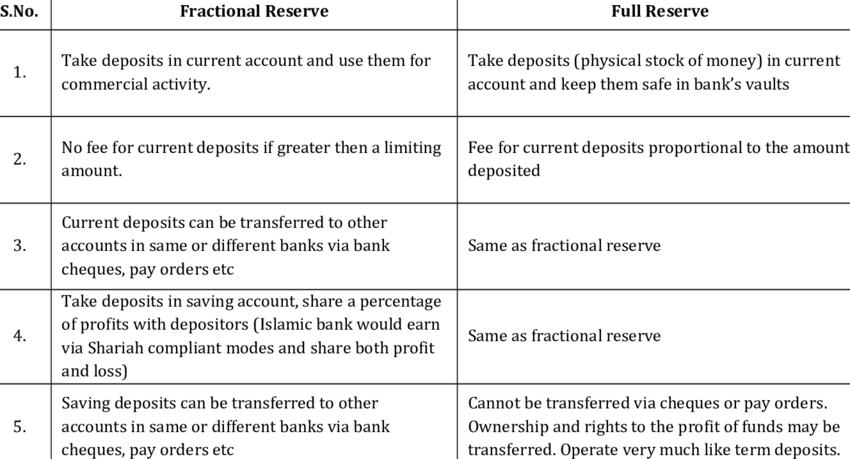

Full-reserve banking, also known as 100% reserve banking, refers to a system of banking where banks are not allowed to lend out money that they receive from customers in the form of demand deposits.

Demand deposits are deposits that customers can withdraw from the bank at any point in time without any prior notice.

So, under full-reserve banking, banks simple act as custodians to depositors' money and may charge a fee for the service of safekeeping that they offer to the depositors.

This is in contrast to today's banking system in which banks pay interest to customers on their demand deposits. In full-reserve banking, banks hold reserves backing 100% of their liabilities in the form of demand deposits. Thus, they avoid a run on the bank even if all depositors someday ask for their money at the same time.

Under this system, banks can only lend money that they receive as time deposits from their customers. Time deposits are deposits that customers can withdraw only after a certain period of time that is agreed upon between the banks and the customers. Hence, banks get the time to lend these deposits to borrowers at a certain interest rate, collect repayments and finally repay depositors their money, along with interest.

Today's banking system is called 'fractional-reserve' system. Banks predominantly do not lend in the form of physical cash, but in electronic money. So the cash deposits they receive mostly stay in their vaults. Still, they face a risk of a depositor run because they lend more than what they have in their vaults.

While under the full-reserve banking system, banks are prohibited from creating loans without actual cash in their vaults to back them.