Current affairs 24th April 2019

Current Affairs and Editorial discussion from various national daily newspapers

Current affairs 24th April 2019

IEPF Authority in a major success recovers Rs 1514 Cr of Depositors’Money

Why in news?

In a major success, the IEPF Authority has been able to enforce The Peerless General Finance and Investment Company Limited to transfer deposits worth about Rs 1514 Cr to IEPF. This depositor’s money was pending with the company for the last 15 years.

What else is IEPF doing?

The IEPF Authority is in the process of commissioning an online facility to collect primary information directly from retail investors about the deposits which have matured and are still pending with various entities for repayment or payment of interests. The online report will capture only essential fields with various dropdown options. The Authority may take various steps to make all such companies and other entities comply with provisions of Companies Act or other allied related legal provisions.

The Authority has also acted against companies that have transferred the unpaid dividend amount to IEPF but have failed to transfer shares in accordance with section 124(6) of the Act. In some other cases, the companies are showing unclaimed and unpaid amounts in their Balance Sheets but have not transferred such amounts to IEPF even after seven years. Based on above, the authority has issued more than 4000 notices to the companies under section 206(4) of the Act for calling information. It has been noticed that there are many companies including NBFC companies which have neither refunded these amounts back to their entitled investors nor have transferred such amounts to IEPF even after expiry of the period of seven years.

About IEPF Authority:

IEPF Authority has been set up under the Ministry of Corporate Affairs, Government of India as a statutory body under Companies Act 2013 to administer the Investor Education and Protection Fund with the objective of promoting Investor’s Education, Awareness and Protection. The Authority takes various initiatives to fulfil its objectives through Investor Awareness Programmes and various other mediums like Print, Electronic, Social Media, and Community Radio etc.

The size of IEPF Fund has almost doubled within one year with accumulated corpus of about Rs 4138 Cr. The companies have also transferred about 65.02 Cr valuing Rs 21,232.15 Cr.

Secretary Ministry of the Corporate Affairs is the Chairperson of the Authority. Joint Secretary Ministry of the Corporate Affairs is the Chief Executive Officer of the Authority.

आईईपीएफ प्राधिकरण को बड़ी कामयाबी मिली, जमाकर्ताओं के 1514 करोड़ रुपये वसूलेः

आईईपीएफ प्राधिकरण को एक बड़ी कामयाबी मिली है, जिसके तहत वह द पीयरलेस जनरल फाइनेंस एंड इन्वेस्टमेंट कंपनी लिमिटेड को विवश कर लगभग 1514 करोड़ रुपये की जमा राशि आईईपीएफ में हस्तांतरित कराने में समर्थ साबित हुआ है।

आईईपीएफ प्राधिकरण एक ऑनलाइन सुविधा शुरू करने की तैयारी में है, जिससे कि उन जमा राशियों के बारे में सीधे रिटेल अथवा छोटे निवेशकों से आरम्भिक सूचनाएं प्राप्त की जा सकें, जो या तो परिपक्व (मैच्योर) हो चुकी हैं अथवा पुनर्भुगतान या ब्याज की अदायगी के लिए अब भी विभिन्न निकायों के यहां अटकी पड़ी हैं। ऑनलाइन रिपोर्ट में केवल आवश्यक सूचनाएं दर्ज की जाएंगी। यह प्राधिकरण इस तरह की सभी कंपनियों और अन्य निकायों द्वारा कंपनी अधिनियम के प्रावधानों अथवा अन्य संबंधित सहायक कानूनी प्रावधानों का अनुपालन सुनिश्चित करने के लिए विभिन्न कदम उठा सकता है।

इस प्राधिकरण ने उन कंपनियों के खिलाफ कार्रवाई की है, जिन्होंने अदा न की गई लाभांश राशि आईईपीएफ को हस्तांतरित तो कर दी है, लेकिन वे कंपनी अधिनियम की धारा 124(6) के अनुसार शेयरों को हस्तांतरित करने में विफल रही हैं। कुछ अन्य मामलों में कंपनियां अपनी-अपनी बैलेंस शीट में बगैर दावे वाली राशियां एवं अदा न की गई रकम दर्शा तो रही हैं, लेकिन उन्होंने सात वर्षों की लंबी अवधि गुजर जाने के बाद भी इस तरह की धनराशियां आईईपीएफ को हस्तांतरित नहीं की हैं। इन जानकारियों के आधार पर प्राधिकरण ने कंपनी अधिनियम की धारा 206(4) के तहत कंपनियों को 4000 से भी ज्यादा नोटिस जारी किए हैं, ताकि उनसे आवश्यक सूचनाएं प्राप्त की जा सकें। यह बात संज्ञान में आई है कि गैर-बैंकिंग वित्तीय कंपनियों (एनबीएफसी) सहित ऐसी अनेक कंपनियां हैं, जिन्होंने न तो इस तरह की धनराशियां अपने संबंधित निवेशकों को रिफंड की हैं और न ही इन्होंने सात वर्षों की अवधि गुजर जाने के बाद भी इस तरह की रकम आईईपीएफ को हस्तांतरित की है।

आईईपीएफ प्राधिकरण के बारे में:-

कंपनी अधिनियम 2013 के तहत एक वैधानिक निकाय के रूप में भारत सरकार के कॉरपोरेट मामलों के मंत्रालय के अधीन आईईपीएफ प्राधिकरण की स्थापना की गई है। इस प्राधिकरण को निवेशक शिक्षा एवं संरक्षण कोष के संचालन की जिम्मेदारी सौंपी गई है और इसके पीछे मुख्य उद्देश्य निवेशक शिक्षा, जागरूकता और संरक्षण को बढ़ावा देना है। यह प्राधिकरण निवेशक जागरूकता कार्यक्रमों के साथ-साथ विभिन्न अन्य माध्यमों जैसे कि प्रिंट, इलेक्ट्रॉनिक, सोशल मीडिया, सामुदायिक रेडियो इत्यादि के जरिए अपने उद्देश्यों को पूरा करने के लिए विभिन्न तरह के कदम उठाता है।

आईईपीएफ कोष का आकार एक साल के भीतर ही लगभग दोगुना हो गया है। इसकी संचित राशि लगभग 4138 करोड़ रुपये है।

कॉरपोरेट मामलों के मंत्रालय में सचिव इस प्राधिकरण के चेयरमैन हैं, जबकि कॉरपोरेट मामलों के मंत्रालय में संयुक्त सचिव इस प्राधिकरण के मुख्य कार्यकारी अधिकारी हैं।

FDI in medical devices

Why in news?

Blanket implementation of price controls has contributed to a drastic fall in Foreign Direct Investment (FDI) in the medical device sector, say industry insiders, pointing to a reduction from $439 million in 2016 to $66 million in 2018.

What could be the reason?

This decline it looks was the unintended consequence of the well-meaning intention but the anomaly needs to be corrected.

We are however talking about a country which imports 70 % of its medical devices and it is only now that we have started manufacturing high end medical devices. While there has been a fall in this sector, it cannot be attributed only to the price control in India. We have always seen that around the election year there is a fall in FDI in all sectors. This is also a growing sector.

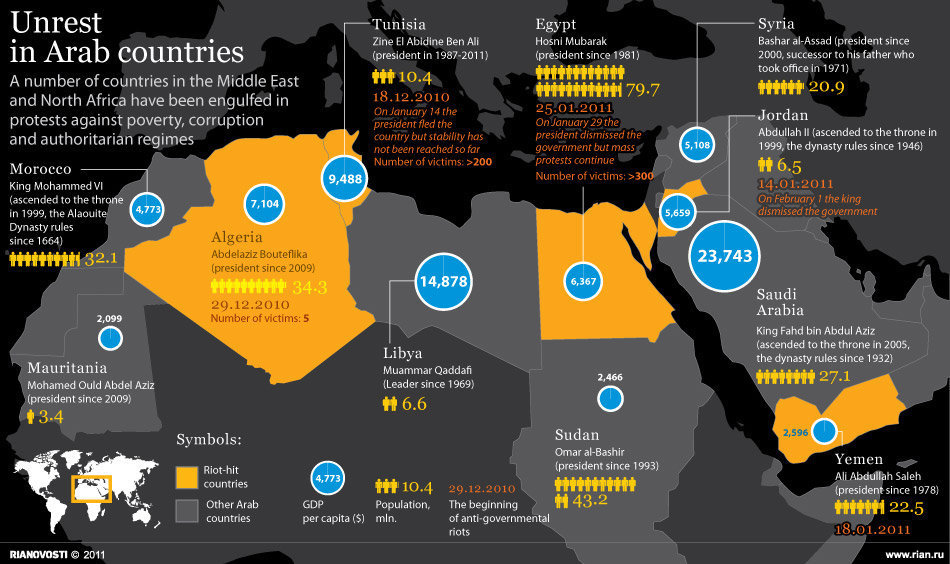

Arab Uprisings

Why in news?

Arab politics remains defiant. Eight years after protests swept through the Arab street toppling several dictators, anti-government demonstrations erupted in Sudan and Algeria in recent months. Earlier this month, both Abdelaziz Bouteflika, who had ruled Algeria for 20 years, and Omar al-Bashir, who had been at the helm in Sudan for three decades, quit amid public anger, reviving memories of the Tunisian and Egyptian uprisings earlier.

What has been the reason of uprisings?

The Arab uprising was originally triggered by a combination of factors. The economic model based on patronage was crumbling in these countries. The rulers had been in power for decades, and there was popular longing for freedom from their repressive regimes. More important, the protests were transnational in nature, though the targets of the revolutionaries were their respective national governments. The driving force behind the protests was a pan-Arabist anger against the old system. That’s why it spread like wildfire from Tunis to Cairo, Benghazi and Manama. They may have failed to reshape the Arab political order, but the embers of the uprisings appear to have survived the tragedy of ‘Arab Spring’.

How important were the economic reasons?

Most Arab economies are beset with economic woes. The rentier system Arab monarchs and dictators built is in a bad shape. Arab rulers for years bought loyalty of the masses in return for patronage, which was then buttressed by the fear factor. This model is no more viable. If Arab countries were shaken by the 2010-11 protests, they would be thrown into another crisis in 2014, with the fall in oil prices. Having touched $140 a barrel in 2008, the price of oil collapsed to $30 in 2016. This impacted both oil-producing and oil-importing countries. Producers, reeling under the price fall, had cut spending — both public spending and aid for other Arab countries. Non-oil-producing Arab economies such as Jordan and Egypt saw aid that they were dependent on drying up.

What was expected of these uprisings?

When protests broke out in Tunisia in late 2010 and spread to other countries, there were hopes that the Arab world was in for massive changes. The expectation was that in countries where people rose, such as Tunisia, Egypt, Yemen, Libya, Bahrain and Syria, the old autocracies would be replaced with new democracies. But except Tunisia, the country-specific stories of the Arab uprising were tragic.

What was the role of counter revolutionaries and geopolitical factors?

The pan-Arabist anger against national governments remains the main driving force behind the protests, which should set alarm bells ringing across Arab capitals. But in all these countries, the counter-revolutionary forces are so strong that protesters often stop short of achieving their main goal — a clear break with the past. They manage to get rid of the dictators, but the system those dictators built survives somehow, and sometimes in a moral brutal fashion. There are two main counter-revolutionary forces in these countries. The first are the main guardians of the old system, either the monarchy or the army. Tunisia is the only country where the revolutionaries outwitted the counter-revolutionaries. They overthrew Zine El Abidine Ben Ali’s dictatorship, and the country transitioned to a multi-party democracy. In Egypt, the army made a comeback and further tightened its grip on the state and society through violence and repression. In Jordan, the monarch always acts as a bulwark against revolutionary tendencies.

The second are geopolitical actors. In Libya, the foreign intervention removed Muammar Qaddafi, but the war destroyed the Libyan state and institutions, leaving the country in the hands of competing militias. Libya is yet to recover from the anarchy triggered by the intervention. In Syria, with foreign intervention, the protests first turned into an armed civil war and then the country itself became a theatre of wars for global players. In Yemen, protests turned into a sectarian civil conflict, with foreign powers taking different sides. In Bahrain, Saudi Arabia made a direct military intervention, on behalf of its rulers, to violently end the protests in Manama’s Pearl Square.

RBI SWAP auction

Why in news?

The Reserve Bank of India’s (RBI's) second three-year dollar-rupee swap auction was a massive success like the first one, even as it took just five large bids to cover the entire $5 billion on offer.

What is it?

The RBI has different tools through which it injects liquidity into financial markets. Adjusting repo rates and purchasing bonds by conducting open market operations (OMO) are a couple of tools which the RBI uses regularly either to increase or decrease the currency supply in the market. The recently announced ‘swap auction’ is one such tool. This is being done to increase the supply of rupees in the market. Technically, this activity is being termed as a USD/INR Buy/Sell Swap Auction.

Through this auction, the RBI will buy US dollars from banks. In turn the RBI will pay rupees to the participating banks at the current spot rate.

Simultaneously, the banks will agree to buy-back the same amount of dollars from the RBI after three years — the tenor of this auction. The participating banks have to bid in the auction by quoting a forward premium in terms of paisa that they will pay to buy back the dollars. For example, if the spot exchange rate is 70 to a dollar, say Bank A quotes a premium of 150 paisa and bids for $25 million. So, the bank will get Rs. 175 crore ($25 million multiplied by the exchange rate of 70). After three years, the bank has to pay back approximately Rs. 179 crore ($25 million multiplied by the exchange rate of 71.5) to the RBI to buy back $25 million.

Why is it important?

Indian financial markets have been undergoing liquidity problems since the IL&FS crisis emerged last year. The RBI is deploying a new weapon to enhance market liquidity. Whether it will hit or miss the target, will be known only over time.